REMOVE THE STRESS FROM BUDGETING AND ASSET LIABILITY MANAGEMENT

Powerful, Intuitive Software and Expert Services for Banks and Credit Unions Who Want Quicker, More Accurate Budgeting and Interest Rate Risk

CECL made easy with our automated, affordable solution.

Build, track, and execute a winning strategy.

Choose the Solution that Meets Your Needs or Schedule a FREE Discovery Call to Determine the Ideal Option for Your Organization

Growing A Community Bank or Credit Union Doesn’t Have to be Difficult

Continually changing banking environments and regulations make it tough to manage change if you don’t have the right tools and resources. Our products have helped thousands of financial institutions:

Make Better Strategic Decisions

Stay Competitive

Improve Budgeting Efficiency

Effectively Manage Interest Rate Risk

Plansmith Makes it Easy to Get the Right Products and Professional Services to Effectively Manage Growth.

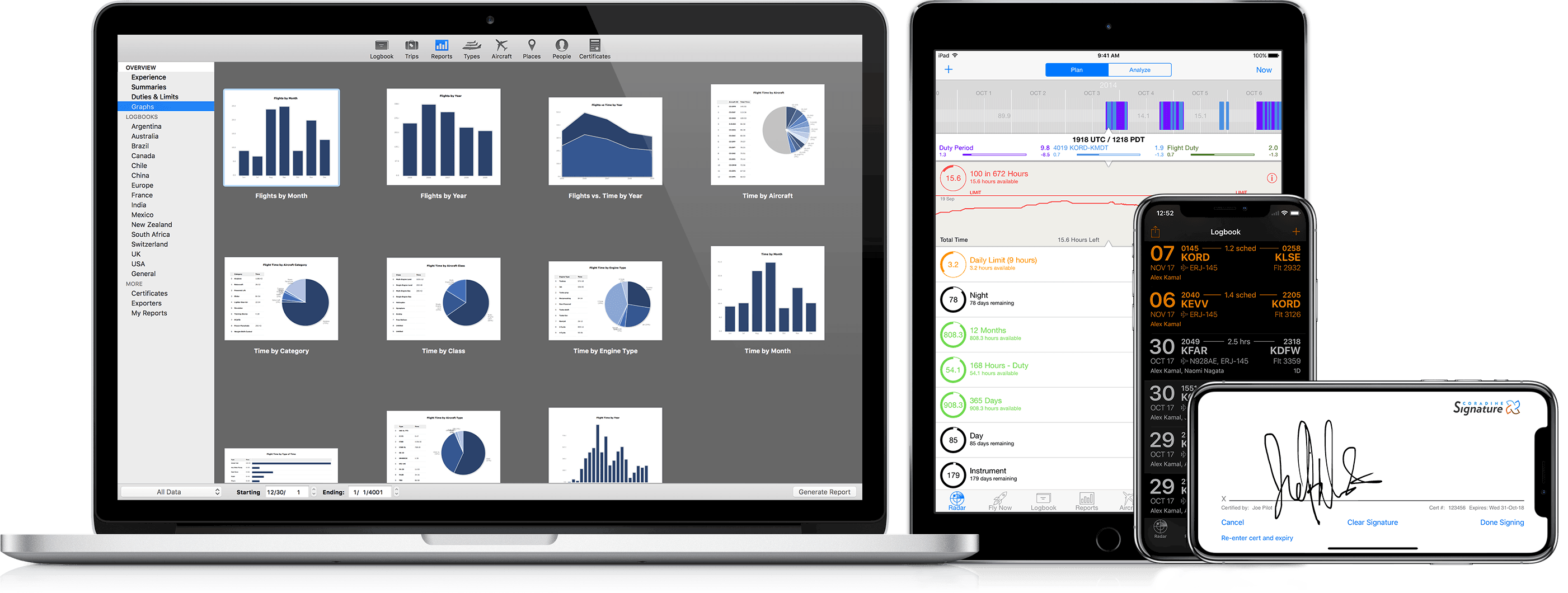

Deploy The Tools You Need To Grow

Hear What Some Of Our Clients Are Saying About Working With Plansmith

What is a lack of adequate tools and resources costing your organization?

Time Wasted On Ineffective Tools

Declining

Market Share

Increasing

Regulatory Pressure

Get The Software And Professional Service You Need To Grow

Just Because You Don’t Have The Resources Of A Larger Bank Doesn’t Mean You Can’t Act Like One.

Read More

As former bankers we understand your frustration. For over 50 years, we’ve worked with many banks and credit unions who have struggled with these issues. Our company has helped thousands of financial institutions stay competitive and grow with software and expert advisory services for strategic planning, market intelligence, budgeting, and risk analysis.

Here’s how easy it is to work with Plansmith:

1. Call to schedule your free discovery meeting.

2. Choose the ideal products and services

3. Deploy the tools you need to grow

Schedule your free discovery call today! And, in the meantime, get your complimentary Strategic Opportunity Score. Stop letting industry changes limit your potential. Get the software and advice you need to grow and continue serving your community.

Get Your Free Market Analysis

Products

Contact

1827 Walden Office Square, Ste. 350

Schaumburg IL 60173

Toll Free: 1.800.323.3281

Local: 1.847.359.4045

Fax: 1.847.705.8200

info@plansmith.com